16. February 2022

Tax rates. Different in every country, and they get changed over and over again.

Just like the culture or the language, the tax rates are a bit different in every country of the world. In order to be able to offer our service internationally, we do research and work closely with our customers. If characteristics like these change due to changes in the law or tax breaks (like now during the pandemic), we react flexibly to them and adapt our AI model accordingly.

Overview of some countries and their tax rates (02/2022).

| Country | Tax Rates |

|---|---|

| Germany | 5%, 7%, 16%, 19% |

| Austria | 5%, 10%, 13%, 20% |

| Spain | 4%, 10%, 21% |

| France | 0.9%, 2.1%, 5.5%, 10%, 13%, 20% |

| Italy | 4%, 5%, 10%, 22% |

| Poland | 5%, 8%, 23% |

| Czech Republic | 10%, 15%, 21% |

| Slovakia | 10%, 20% |

| Netherlands | 6%, 9%, 21% |

| Portugal | 5%, 6%, 10%, 12%, 13%, 18%, 22%, 23% |

| United Kingdom | 5%, 20% |

| New Zealand | 15% |

| Australia | 10% |

| Mexico | 16% |

| South Africa | 14%, 15% |

| Switzerland | 2.5%, 3.7%, 3.8%, 7.7%, 8% |

| Norway | 6%, 11.1%, 12%, 15%, 25% |

| United Arab Emirates | 5% |

| Turkey | 1%, 8%, 18% |

| Sweden | 6%, 12%, 25% |

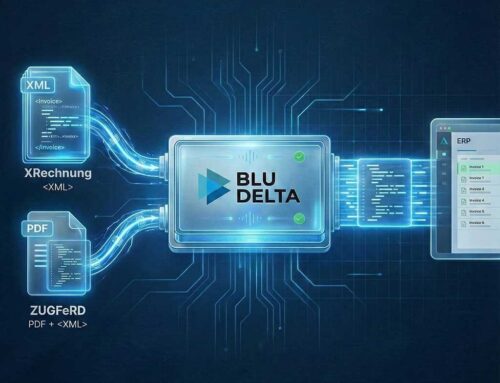

BLU DELTA is a product for the automated capture of financial documents. Partners, but also finance departments, accounts payable accountants and tax advisors of our customers can use BLU DELTA to immediately relieve their employees of the time-consuming and mostly manual capture of documents by using BLU DELTA AI and Cloud.

BLU DELTA is an artificial intelligence from Blumatix Intelligence GmbH.

Author: Andrea Pauritsch studied Information Technology and System Management at the University of Applied Sciences in Salzburg after completing her training at the Federal Commercial Academy in Hollabrunn, while working at the IT Helpdesk. Since January 2022 she has been supporting the Blumatix Intelligence GmbH team in the areas of customer service, marketing and data management

Contact: a.pauritsch@blumatix.com